Mazagon Dock Share Price Target 2025, 2030, 2040, 2050: From the beginning of its establishment till now, Mazagon Dock Shipbuilders Limited which is a public sector enterprise from India has been involved into defense and sea infrastructure of the nation. The company has made remarkable strides over time thereby augmenting India’s naval architecture and making huge strides within shipbuilding industry at large. With enhanced capacity and extensive market base, investors want to know more about upcoming price targets for its stocks.

Mazagon Dock Share Price Target 2025: Company Overview

Mazagon Dock Shipbuilders Limited was Established in 1934 as a private company. The company nationalized after India attained independence in 1960 when it was taken over by the Indian Government. Mazagon Dock is under Ministry of Defence and it plays a major role in India’s defense production process. This firm has made its mark on designing globally-renowned warships and submarines that have significantly boosted the Indian Navy’s fleet strength.

More so, in the recent past, the company’s stock has been growing rapidly. As at March 5 2024, Mazagon Dock’s share price has very much risen up to stand at double what it did stand before on March 6 2023; this means it has achieved unprecedented levels of growth. Due to this surge, investors and analysts are creating projections about the future of this company’s performance.

Mazagon Dock Share Price Target 2025 : Future Price Predictions

Mazagon Dock Share Price Target 2025 : Future Price Predictions

Mazagon Dock Share Price Target 2025 : Future Price Predictions

This post is going to delve into forecasts on Mazagon Dock’s share price over the next few decades using present-day market trends, financial projections and industry analyses.

Mazagon Dock Share Price Target 2025, 2030, 2040, 2050: Detailed Share Price Targets

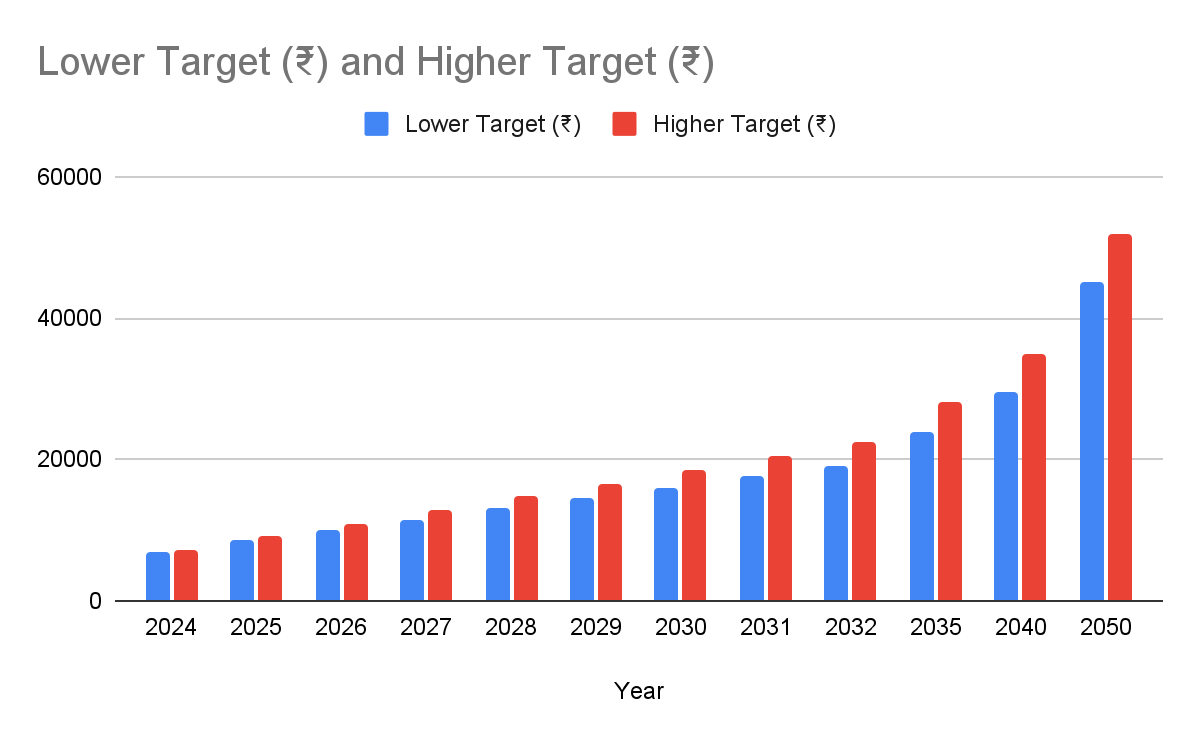

2024: Based on expert forecasts for stock market dynamics, it is expected that there will be ups and downs, hence the price of Mazagon Dock shares could range from ?6993.80 to ?7335.45. The steady increase in price targets for 2024 reflects good business sense within the company and indicates its solid earnings record.

| Year |

Lower Target (?) |

Higher Target (?) |

| 2024 |

6,993.80 |

7,335.45 |

2025: As per the technical analysis conducted in 2025, it is anticipated that the least target price could be estimated at ?8,513.90 while a maximum possible estimate would be ?9,062.95 for Mazagon Dock stocks by the end of 2025 given all ongoing contracts’ worth noting together with trends as good will always prevail over bad.

| Year |

Lower Target (?) |

Higher Target (?) |

| 2025 |

8,513.90 |

9,062.95 |

2026: In 2026 projections, growth is expected to prevail, with share price levels ranging from ?10,026.56 to ?10,915.81. In addition a number of defence projects might be realised this year leading to increased investor confidence and share values.

| Year |

Lower Target (?) |

Higher Target (?) |

| 2026 |

10,026.56 |

10,915.81 |

2027: End of 2027, ?11,545.12 to ?12,853.52 may be the price range for Mazagon Dock. The completion of some major shipbuilding projects and the increase in defense spending by the government are expected to help in this regard.

| Year |

Lower Target (?) |

Higher Target (?) |

| 2027 |

11,545.12 |

12,853.52 |

2028: Mazagon Dock’s share price is predicted to touch a minimum of ?13,057.13 and reach a maximum of ?14,855.14 dollares by the conclusion of 2028. It is anticipated that this growth pattern will persist due to healthy fiscal standing and well-planned actions.

| Year |

Lower Target (?) |

Higher Target (?) |

| 2028 |

13,057.13 |

14,855.14 |

2029: The anticipated range of share prices for 2029 falls between ?14,560.81 to ?16,640.01 whereas continuing inventive development and extension of the navigation construction industry together with friendly state regulations have a right to boost this development.

| Year |

Lower Target (?) |

Higher Target (?) |

| 2029 |

14,560.81 |

16,640.01 |

Mazagon Dock Share Price Target 2025 : Future Price Predictions

Mazagon Dock Share Price Target 2025 : Future Price Predictions

2030: The shares of Mazagon Dock are projected to be valued from ?16,092.10 up to ?18,549.20 by the year 2030. Factors behind this escalation in price may include the company’s historical growth patterns as well as its strategic goals for the future.

| Year |

Lower Target (?) |

Higher Target (?) |

| 2030 |

16,092.10 |

18,549.20 |

2031: In between ?17,623.39 and ?20,458.38 is the projected share price by the close of 2031. The foregoing growth will probably be advocated by production capacity extension and delivery of successful projects.

| Year |

Lower Target (?) |

Higher Target (?) |

| 2031 |

17,623.39 |

20,458.38 |

2032: Based on various studies, it is estimated that stock prices will range from ?19158. 87 to ?22372.80 within the year 2032. It has been suggested that during this time period, the company might consider breaking into new markets or increasing its presence in foreign countries.

| Year |

Lower Target (?) |

Higher Target (?) |

| 2032 |

19,158.87 |

22,372.80 |

2035: Mazagon Dock Stocks may reach a value between Rs 23752.74 and Rs 28100.35 at the end of 2035 if one evaluates long-term growth chances. Cumulative growth, innovation as well as strategic partnerships are expected to drive progress during this time.

| Year |

Lower Target (?) |

Higher Target (?) |

| 2035 |

23,752.74 |

28,100.35 |

2040: Between March 2022 and September 2022 various news articles reported that company stock market Indian price went up because people have bought more of these shares thereby driving their prices up about year. It is thought that by 2040 the value of these stocks will fluctuate between ?29400.00 and ?34800.00 thereby indicating constant growth while possessing substantial influence in stock exchanges.

| Year |

Lower Target (?) |

Higher Target (?) |

| 2040 |

29,400.00 |

34,800.00 |

2050: By 2050 Mazagon Dock’s share price is predicted to be anywhere from ?45,000.00 to ?52,000.00. This long term forecast is based on persistent growth, technological progress and increasing global presence.

| Year |

Lower Target (?) |

Higher Target (?) |

| 2050 |

45,000.00 |

52,000.00 |

Mazagon Dock Share Price Target 2025, 2030, 2040, 2050:Financial Performance and Key Metrics

This is because an organization’s financial performance as well as its position in the market are important aspects to consider if one is to understand these predictions. Below is a summary of the financial outcomes for Mazagon Dock in terms of income, gainfulness, outgoings as well as market ratios.

Revenue and Profitability

For Mazagon Dock, increased sales and profits are a reflection of its excellent management and planning strategies.

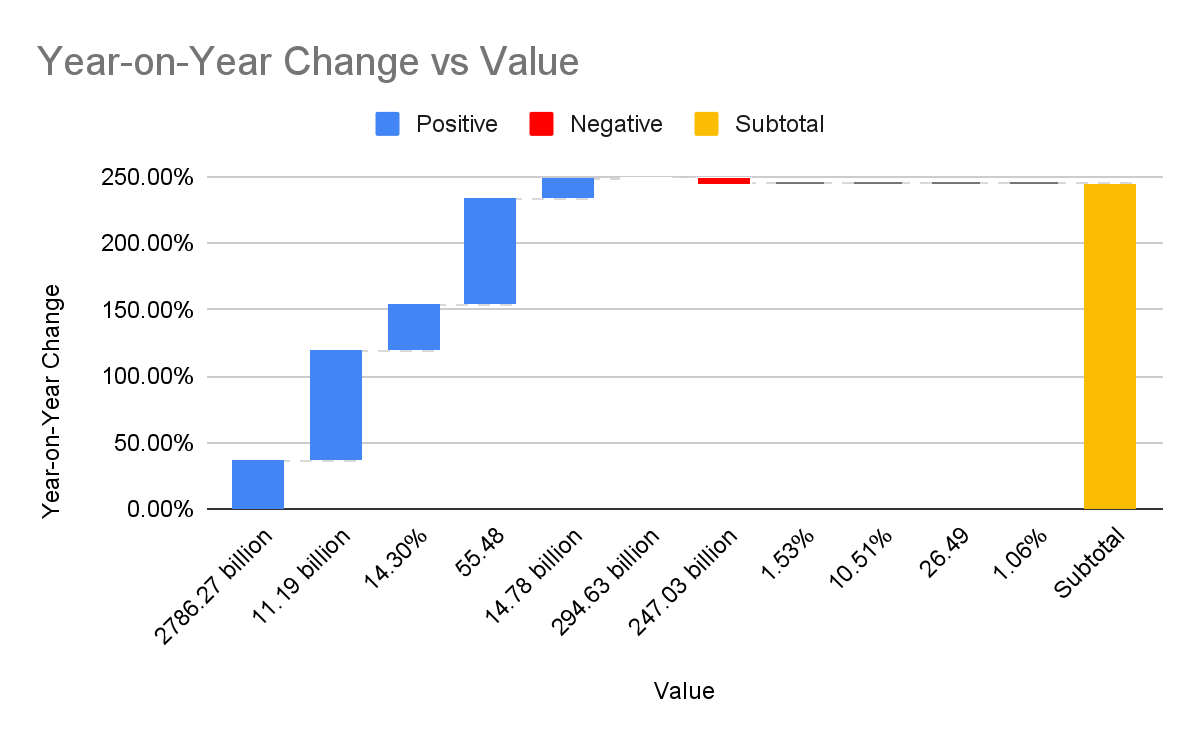

- Revenue: ?2786.27 billion, showing a 36.52% increase year on year. Such an impressive leap serves as a testament to the company's competence in winning contracts for huge projects and executing them successfully.

- Net Income: ?11.19 billion, representing an 83.20% rise year over year. The large increase in net income reflects better operational efficiency and cost control.

- Net profit margin: 14.30%, which is an increase of 34.27% compared to the previous year. It is a sign of good profit margins for the firm, meaning that it can still make money amidst all those increasing prices.

- Earnings Per Share (EPS):?55.48, which indicates an increase of 80.07% over the preceding year. Since an increase in EPS implies greater profits per share for the firm, this has a positive impact on stockholders.

Mazagon Dock Share Price target: Expenses and Liabilities

Mazagon Dock Share Price target: Expenses and Liabilities

Mazagon Dock Share Price target: Expenses and Liabilities

Mazagon Dock has managed its expenses and liabilities effectively, which has contributed to its strong financial position.

- Operating Expense: ?14.78 billion, up 15.37% year on year. The increase in operating expenses reflects the company's increasing operations and increased project activity.

- Total assets were ?294.63 billion, a little decline of 1.03% year on year. Despite the minor dip, the corporation still has a robust asset basis to support its activities.

- Total liabilities decreased by 4.67% to ?247.03 billion compared to the previous year. The reduction in obligations reflects proper debt management and financial discipline.

Mazagon Dock Share Price:Market Ratios

Mazagon Dock's market ratios provide insights into its valuation, profitability, and return metrics.

- P/E ratio: 26.49. A P/E ratio of 26.49 indicates that the market places high expectations on the company's future growth.

- Dividend yield: 1.06 percent. A low dividend yield shows that the company is reinvesting a considerable percentage of its profits back into the business for future growth.

- Return on assets: 1.53%. This ratio measures the company's ability to create profits from its assets.

- Return on Capital: 10.51 percent. A high return on capital suggests that capital is used efficiently to generate profits.

| Metric |

Value |

Year-on-Year Change |

| Revenue |

?2786.27 billion |

36.52% |

| Net Income |

?11.19 billion |

83.20% |

| Net Profit Margin |

14.30% |

34.27% |

| Earnings Per Share (EPS) |

?55.48 |

80.07% |

| Operating Expense |

?14.78 billion |

15.37% |

| Total Assets |

?294.63 billion |

-1.03% |

| Total Liabilities |

?247.03 billion |

-4.67% |

| Total Equity |

?47.60 billion |

Not Available |

| Return on Assets |

1.53% |

Not Available |

| Return on Capital |

10.51% |

Not Available |

| P/E Ratio |

26.49 |

Not Available |

| Dividend Yield |

1.06% |

Not Available |

Mazagon Dock Share Price: Shareholding Pattern

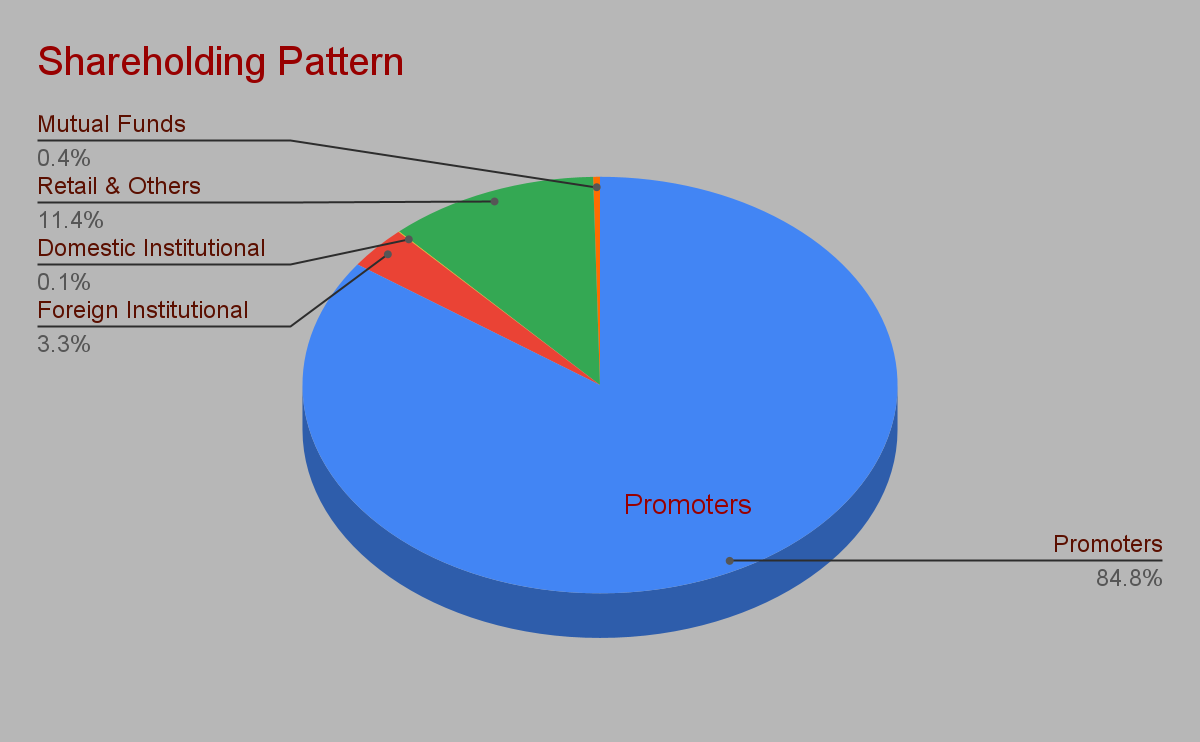

The shareholding pattern of Mazagon Dock reflects a strong presence of government and institutional investors.

- Promoters: 84.83%. The substantial promoter holding demonstrates significant government support and trust in the company's future.

- Foreign Institutional Investors (FII): 3.32%. The presence of FIIs indicates that the company is gaining international investor attention.

- Domestic Institutional Investors (DII): 0.05%. DII presence is minimal, indicating that domestic institutional investment is low.

- Retail & Others: 11.43%. A sizable fraction of shares held by ordinary investors demonstrate widespread public interest.

- Mutual Funds: 0.37%. Limited mutual fund investment shows that the company has yet to become a popular choice among mutual funds.

Mazagon Dock Share Price: Conclusion

If you speak of an organization that is bound to increase its market share, it should be Mazagon Dock Shipbuilders Limited. This company boasts of sound financials, a solid position in the industry and friendly trends in the marketplace resulting into continuous price appreciation. The following is an overview of projections and financial insights discussed:

- 2024-2025: The share price is expected to range between ?6,993.80 to ?9,062.95, reflecting steady growth supported by strong financial performance and market conditions.

- 2026-2027: Continued growth with share prices projected to range from ?10,026.56 to ?12,853.52. This period will benefit from ongoing projects and increased defence spending.

- 2028-2030: The share price targets are between ?13,057.13 and ?18,549.20, driven by robust financial health and strategic initiatives.

- 2031-2035: Long-term growth prospects with share prices ranging from ?17,623.39 to ?28,100.35. This period will likely benefit from cumulative growth and strategic partnerships.

- 2040-2050: Significant long-term growth with share prices expected to range from ?29,400.00 to ?52,000.00, reflecting sustained growth and robust market presence.

Investors should consider these projections and the company's financial health before making investment decisions. It is important to conduct thorough research and consult with financial advisors to make informed choices.

Disclaimer: The information in this “Stock Profile” blog post is for informational purposes only. It is not financial advice. Always consult a qualified expert before making investment decisions.