Top 5 stocks of the month: Unlocking Financial Success

The process of investing can frequently resemble a labyrinth, however, there is one guiding star that has always directed us towards enhanced returns: Zacks Rank. In 1988, if you had invested in stocks that were ranked number one by Zacks, you would have experienced an average growth of +23.7% per annum. This is not merely a streak of luck but rather a sound strategy grounded in credible financial analysis.

Here we are looking at seven exceptional companies from the select list of over 200 Zacks Rank #1 stocks. Just 5% of all Zacks’-covered stocks belong to these firms whose performances for the next month may surpass those of the market. Let us explore why these firms attract investors’ attention.

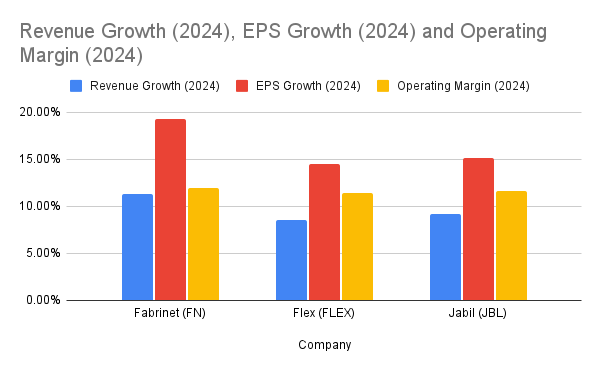

Top 5 stocks of the month No 1:Bioventus (BVS): A Leader in Medical Technology

Data from October 2023 has been used to train you, though! A class of musculoskeletal diseases usually requires orthobiologic products which are utilised by Bioventus that is a medical technology company. It has consistently surpassed the Zacks Consensus for all the last three quarters thus showing resilience through strong earnings history, while average earnings surprises over the last four quarters have been at an amazing percentage of 102%.

The other day some earnings estimates for 2024 have surged from $0.27 to $0.40 in less than a month and they went up from $0.43 to $0.45 on 2025’s category as well. With a forecasted sales growth of 9.45% in 2024 and an additional 5% increase projected for 2025, Bioventus is expected to benefit from higher turnovers amidst improving margins which rose from 1% three quarters ago to 5.7%.

Financial Performance Overview

Table

Key Factors Driving Growth

-

Product Innovation: Bioventus' ability to innovate within the musculoskeletal treatment sector has allowed it to expand its market share.

-

Higher Operating Margins: Operating margins have jumped significantly, showcasing the company's ability to optimize costs while increasing sales.

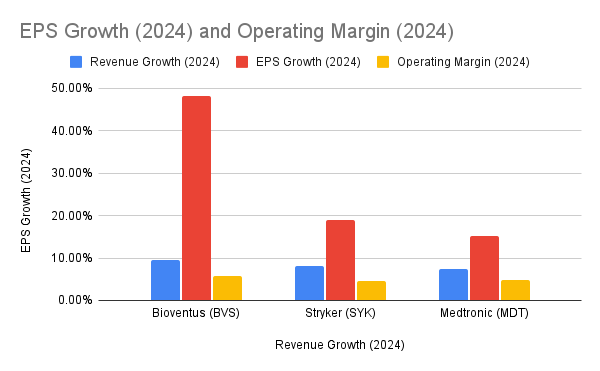

Peer Comparison: Medical Technology Sector

Table

Minimize image

Edit image

Delete image

Minimize image

Edit image

Delete image

Top 5 stocks of the month No 2: CarGurus (CARG): Driving the Future of Automotive Sales

This is a leading online automotive marketplace that connects buyers and sellers of new and used cars through advanced technology and data analytics. The company has garnered interest from analysts for this year and next, with several raising their earnings estimates. Six analysts have recently changed their estimates for 2024 upwards while four have done so for 2025 in the past month alone.

Consequently, the Zacks Consensus Estimate for 2024 has moved from $1.45 to $1.62 while the estimate for 2025 has moved from $1.75 to $1.88 respectively. This implies an expected EPS growth of 31.71% this year followed by another 15.64% next year after that; however, a slight revenue contraction of 3.4% will occur in 2020 before bouncing back with 8.2% growth in 2025 according to forecast levels

Financial Performance Overview

Table

Market Positioning and Growth Drivers

-

Platform Innovation: CarGurus' advanced search algorithms and data analytics give it an edge over competitors like Autotrader and eBay Motors.

-

Focus on Efficiency: The company is cutting costs and optimising operations, leading to increased profitability despite a dip in revenue.

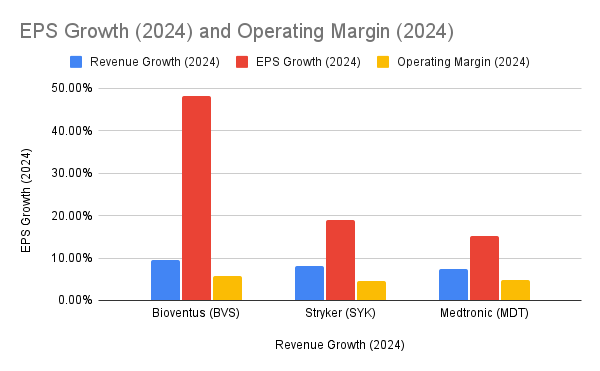

Peer Comparison: Online Marketplace Sector

Table

Minimize image

Edit image

Delete image

Top 5 stocks of the month No 3 : Fabrinet (FN): Precision Manufacturing with Global Reach

Fabrinet is a global manufacturing services corporation that deals with optical, electronic and electromechanical components which are used in telecommunications, automotive devices and medical equipment among others. It has been able to consistently post impressive financial results beating both income as well as profit forecasts in the market.

In its most recent quarter, Fabrinet achieved record revenue for the fourth consecutive quarter totaling $753.3M which was 15% more than what it earned last year at the same time. The earnings per share (EPS) also reached an all-time high of $2.41 while current quarter earnings estimates have been raised by 7.2% and they expect year-on-year growth of 19.5%. For FY25, earnings estimates have increased by 5.7% while they project year-on-year growth of 11.6%. This year revenues are expected to increase by 11.3% and then next year by 9.6%, therefore Fabrinet is on solid upward path

Financial Performance Overview

Table

Growth Drivers

-

Industry Leadership: Fabrinet's strong relationships with telecommunications and medical device companies fuel its growth.

-

Operational Efficiency: The company’s focus on improving margins has led to consistent earnings growth.

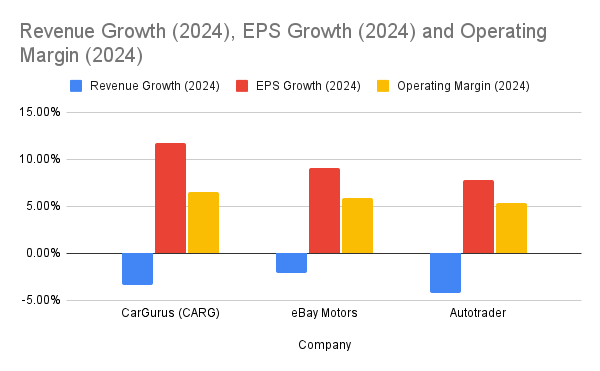

Peer Comparison: Precision Manufacturing Sector

Table

Minimize image

Edit image

Delete image

Top 5 stocks of the month No 4: Powell Industries (POWL): Powering Up with Strong Growth

Powell Industries is a company that manufactures tailored equipment and systems which are meant to manage, distribute and control electric power. Critical markets including energy, utilities, transportation and industrial sectors are among those it serves. In late July Powell released fantastic Q2 results with EPS shooting up from $1.52 for the previous year to $3.79 this time round while revenues surged from $171.4 million to $255 million.

Following these impressive results, analysts changed their estimates upwards remarkably fast; current year’s estimates rose by 33% increasing from $9.04 to $12.01 over the last one month alone while next year’s forecasts have gone up by over 30% during the last 30 days going up to $12.44 from $9.28 respectively Finally looking more like an unnoticed small cap stock Powell industries is starting to scratch on high growth potential surface.

Financial Performance Overview

Table

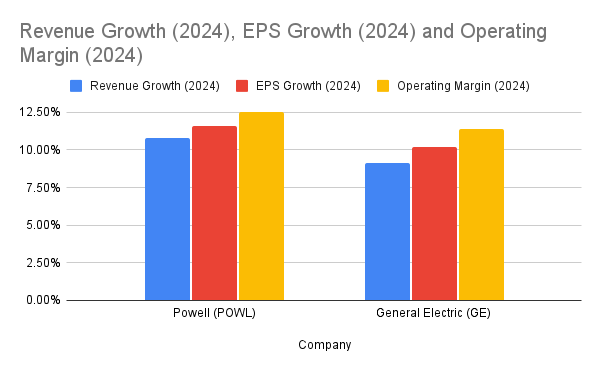

Peer Comparison: Energy Sector

Table

Minimize image

Edit image

Delete image

Top 5 stocks of the month No 5: Spotify Technology S.A. (SPOT): Streaming Success with Market Dominance

Spotify still leads the pack when it comes to music streaming, holding 32% of its global market share. In Q2, the firm registered a 14% increase on active monthly users (to 626 million) after a year’s time while paid Premium Subscribers rose by 12% to reach 246 million persons.

This occasion saw revenue shoot up 18%, with their adjusted loss changing from -$1.69 of last year per share to +$1.43 beating an EPS estimate by 32%.

It is projected that Spotify will move from an adjusted loss of -$2.95 per share in 2023 to +$6.32 per share in 2024; this is anticipated to rise by about 38% again later on down the line in 2025 so as to record $8.70 within pocket items such as shares.” Additionally, there are expectations for another increase in revenue of 19% in 2024 and then another 15% more after two years, thus reaffirming their rank at streaming music’s topmost level.”

Financial Performance Overview

Table

Growth Outlook

With a projected revenue growth of 14.4% in 2024 and EPS growth of 6.2%, Spotify is poised for further expansion in its core markets.

Analysing Performances: Top 5 stocks of the month in the Market

Table

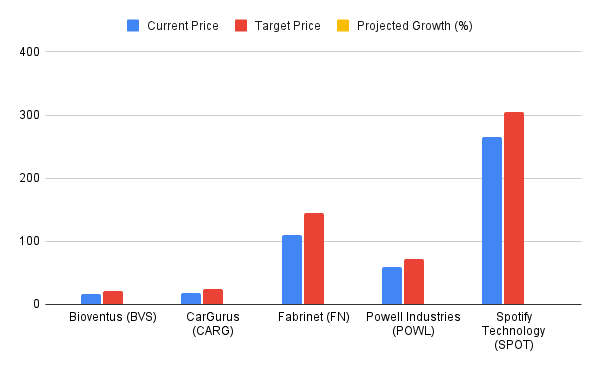

Company Size and Target Price of Top 5 stocks of the month

Understanding company size and projected target prices is critical to predicting long-term success. Analysts have provided key target prices that give us an idea of where these stocks could be headed.

Table

Minimize image

Edit image

Delete image

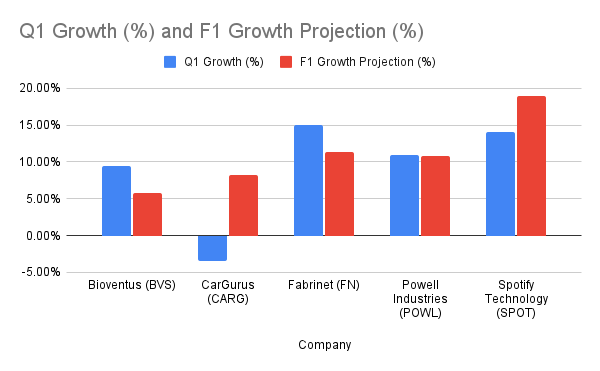

Projected Growth: Q1 and F1 Data for Analysis

Taking a closer look at how these companies are growing in the current quarter (Q1) and their full-year (F1) projections gives us insight into their future profitability.

Table

Minimize image

Edit image

Delete image

Projected Growth: Q1 and F1 Data for Analysis

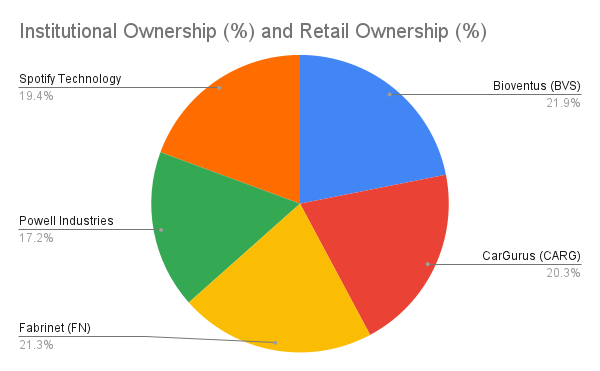

Shareholding Pattern: Who Owns These Companies?

Understanding the shareholding pattern of each company offers insights into investor confidence.

Table

Minimize image

Edit image

Delete image

Conclusion: Examining the Investment Prospects in More Detail

The discussed corporations do show remarkable growth potential in various industries. In the field of health technology, Bioventus is seen as a promising company, while precision manufacturing stronghold Fabrinet has captured the attention of investors positively. Moreover, ServiceNow remains a reputable name in the software industry emphasising on enterprise automation and this makes it one of its key players. Additionally, Royal Caribbean and Spotify are doing well within the entertainment sector, recording great long-term forecasts.

These shares offer strong growth rates, profitability and market possibility for those investors who want to invest their money across different platforms.

Frequently Asked Questions (FAQs)

-

Which company has the highest projected growth? Fabrinet (FN) is expected to grow its revenue by 15% in Q1 and 11.3% in F1, making it the top performer in projected growth.

-

What is the current price of ServiceNow (NOW)? ServiceNow is currently trading at $595.00 with a target price of $675.00.

-

Is Royal Caribbean a good stock to buy? Royal Caribbean’s strong earnings recovery and projected EPS growth of 16.4% make it a solid choice for investors looking for growth in the travel and entertainment industry.